Repair Credit history? Repair Credit Rating? Is it Worth All The Bonus Initiative? You should check your credit rating reports and official

credit report at the very least annually, or much more typically, when you are preparing for a large

acquisition, such as a home or automobile. If you place'' t seen your credit report records and

credit history in the previous ninety days, you should most likely to http://www.creditreportstogo.com

– their credit report records and format are basic to read and comprehend, and unlike various other sites,

they offer official credit scores scores.Once you have the credit score report and scores, you require

to analyze it.It’s not tough to do. To repair credit rating and repair service credit report ratings

you will require to search for both apparent and refined errors. Do not think that tiny mistakes don’t injured

you. Examine every little thing; Experience trade lines,

take a look at the settlement history, balance and credit line. Make a listing of every mistake or recent change.The

most usual sort of mistake to fix are mistakes associated with your name, your address, previous

addresses and work history. Typically a misspelled name or wrong address

can lead to another person’s credit score items revealing on your credit history report.Another typical mistake

is credit items that come from household members showing up on your credit scores report. Spouses and ex-spouses and youngsters are a. significant example of what creates credit scores report mistakes, identity burglary and complication of reporting. data. It’s a typical practice for parents to

call. their children after themselves, such as junior, senior, and so forth. However this additionally brings about kids and moms and dads,. and partners inheriting each others credit score things, both good and poor. Joint accounts in between partners or youngsters. should appear on both of their credit score reports, not simply one or the various other. Are you sure it was a joint account, or is. it a mistake? If it is your spouses or child’s credit. item, and there is a late repayment on your debt, but the account is not a joint account,.

then it is not exact. Likewise seek incorrect late repayments. If your monthly repayment scheduled on January.

10th and you did not make your January repayment until February 1st, yes you are late, however.

you are not one month late or more.If the creditor has reported you as 1 month. late and it was actually 29, that is an error and the regulation mentions it needs to be gotten rid of. It’s also an usual method for creditors. and banks to bill you a late cost.

They likewise go one step even more and bill you. a late charge, for not paying a late fee in a prompt manner. It’s not lawful in the majority of states, however it occurs. frequently. Try to find equilibrium and credit line changes. Look at every little thing since everything has an. effect on your debt score and credit rating scores.

It is a typical technique for bank card firms. and financial institutions to drop your debt limitation.

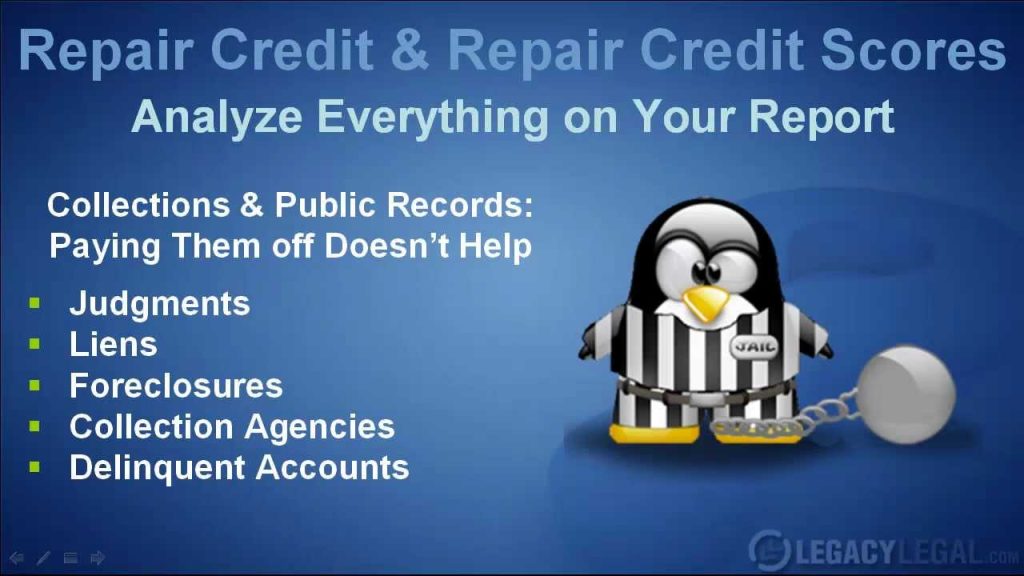

This will influence your balance-to-credit limitation. proportion which governs 30% of your credit history. If your equilibrium is greater than 25 %of your credit scores. limit, you need to pay for your financial debts repair your credit report. Look for collection accounts and public documents. To fix credit report and repair service credit history,. you have to address all collection accounts and

public documents such as judgments and liens.These are among the most damaging of products.

Yes, you may have been taken legal action against and yes a judge. might have heard your instance.

That doesn’t mean the thing is reported accurately,. and if it’s not accurate, it is not enabled by law to be positioned on your credit report. The most usual mistake of this kind is not. reporting a judgment or a lien as satisfied, implying settled. It holds true that a paid off adverse item is. far better than an unpaid adverse item. Repaying an item does not alter it from. negative to positive. However, it is far better to not have the adverse. item on your record whatsoever.

So if it’s not appropriately reported, attempt to. get the product removed, not just corrected. Fixing a public record is useless. It’s kind of like being convicted of a crime,. and fixing it is like being placed on parole.

It is much better that the conviction, or unfavorable. product not appear on your report in any way.

If the bureaus won’t remove the product,. you might desire to consult your attorney to petition the court to have the public record removed,. which can be expensive.Having an overdue judgment is not a criminal activity,.

but it can make you a high debt risk If you can not afford a lawyer to do this for. you, you should work with an economical debt fixing firm to repair debt and fixing. credit rating. Credit score bureaus don’t such as to fix credit rating. or to repair credit history. They earn money by offering your information,. and financial institutions make even more money and charge higher passion rates to individuals that have late. payments and other derogatory comments. Credit history bureaus also play word games with the. credit report coverage regulations. They specify the word “Accurate” as an

. product that has been confirmed at the source, after it has actually been challenged. So by their interpretation of exact, it could. be claimed that nothing on your debt report is exact until they validate the info. with the source, after you test it’s precision.

Repairing your credit and credit history is. worth it. In today’s economy, you require to have the. best debt rating and credit rating to obtain the very best rates on car loans, and insurance policy, and.

even to get a much better paying task. You can do it on your very own, it is simply laborious.

and needs initiative and determination.If you do not have the moment to do it on your own,. work with an affordable credit scores

repair work business. Thank you for watching, and all the best. (Captioned by http://www.LegacyLegal.com).